Income Generator: Income Drives Outcomes

Amidst a backdrop of diverging growth and inflation trends driving central bank policy, three strategies for global investors remain as relevant today as they were in the beginning of the year.

Download PDF

Key takeaways

- Diversify duration. Spread duration across different yield curves to maximize income and capture return potential.

- Prioritize flexibility. Diversify across sectors and securities to remain nimble.

- Be intentional with risk. Use high nominal and real yields to build durable, inflation-beating cash flows over multiple years.

In our January 2024 edition, we identified these three basic strategies for bond investors worldwide to follow this year:

- Diversify duration. Spread duration across different yield curves to maximize income and capture return potential.

- Prioritize flexibility. Diversify across sectors and securities to remain nimble.

- Be intentional with risk. Use high nominal and real yields to build durable, inflation-beating cash flows over multiple years. This was doable in 2023 and could be again in 2024.

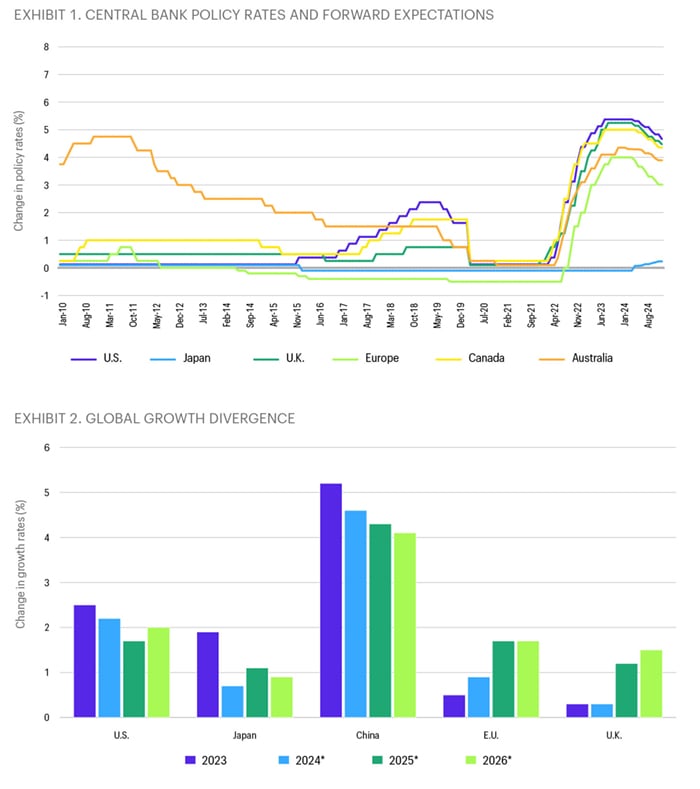

After the first three months of 2024, we’re happy to say these three strategies are just as relevant today as they were in January and they’re likely to remain so over the rest of 2024 and into 2025. Bond markets are in a transition period as the Federal Reserve and other central banks start to shift policy (Exhibit 1) in response to diverging growth (Exhibit 2) and inflation trends.

Sources: Allspring and Bloomberg Finance LP. Each country’s policy rate is represented by Bloomberg’s pricing. Growth rates come from official statistics reported by Bloomberg. *Denotes consensus estimates as tracked by Bloomberg. Data is as of 29-Mar-24.

On the positive side, bonds are doing exactly what they’re designed to do—namely, generate consistent, predictable cash flows that we believe should beat inflation over time. On the negative side, pernicious inflation has yet to fully abate in some economies around the world. We expect further disinflation will continue to unfold—led by emerging economies and Europe—while the U.S. is likely to follow, but with a lag. Fortunately, bond yields are still at levels that should compensate for “sticky” inflation and the possibility that trend inflation1 settles above the target rates that central banks set a few years ago.

Bond investors should consider the following themes and strategies as they position their portfolios for the rest of this year and beyond:

- Diversify duration. Spreading duration across the curve and across global markets could allow bond investors to maximize income and capture return potential.

- Positioning: Consider adding duration at the front end of yield curves; yields curves are likely to steepen and/or “twist.” We favor duration in Europe and emerging economies, neutral positioning in the U.S., and underweighting Japan.

- Strategies: Ultrashort duration strategies coupled with a high income yield advantage should perform for taxable, tax-exempt, and global bond investors.

- Prioritize flexibility. The cone of uncertainty remains wide in financial markets as economic cycles diverge globally and political shifts emerge around the world. Also, monetary policy has started diverging—with some countries cutting rates; others likely to cut rates; and Japan, the notable outlier, starting to tighten policy after 17 years of ultra-loose policy. With such a wide range of macro crosscurrents, it’s our strong opinion that diversifying across sectors and securities to remain nimble and opportunistic is likely the best strategy for bond investors this year. This isn’t an environment to “set it and forget it.”

- Positioning: Consider adding incremental yield at the front end of yield curves by going down the rating spectrum, up to and including high yield; using high-quality duration at the long end; and including structured products and mortgage-backed securities (MBS) where possible in the intermediate part of the curve.

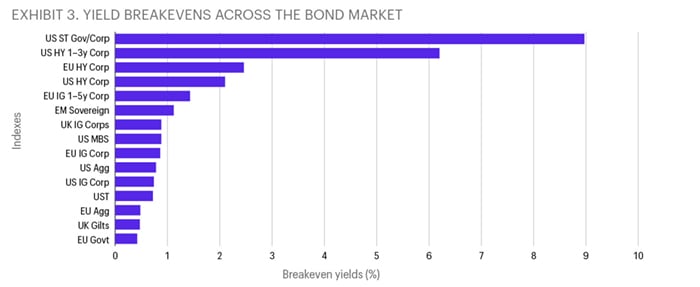

Sources: Allspring and Bloomberg Finance LP. Breakeven is the estimate of how much yields would need to rise for the sector to generate a negative return over a one-year holding period assuming no defaults. Each sector is part of the Bloomberg Global Aggregate Bond Index. Data is as of 29-Mar-24. US ST Gov/Corp = Bloomberg U.S. 1-3 Year Government/Credit Bond Index; US HY 1-3y Corp = Bloomberg U.S. 1-to-3 Year High Yield Bond Index; EU HY Corp = Bloomberg Pan-European High Yield Index; US HY Corp = Bloomberg U.S. Corporate High Yield Index; EU IG 1-5y Corp = Bloomberg Euro Corporate 1-5 Year Bond Index; EM Sovereign = Bloomberg Emerging Markets Hard Currency Aggregate Index; UK IG Corps = Bloomberg Sterling Corporate Bond Index; US MBS = Bloomberg US Mortgage Backed Securities (MBS) Index; EU IG Corp = Bloomberg Euro Aggregate Bond Index; US Agg = Bloomberg U.S. Aggregate Bond Index; US IG Corp = Bloomberg U.S. Corporate Bond Index; UST = Bloomberg U.S. Treasury Bond Index; EU Agg = Bloomberg Euro Aggregate Bond Index; UK Gilts = Bloomberg Barclays Sterling Gilt Index; EU Govt = Bloomberg Euro Treasury Index

(Definitions of all indexes in Exhibit 3 can be found here.)

- Strategies: We believe multi-sector debt strategies that include the “plus” part of the bond market could allow investors to capture generous amount of income while also layering in protection against unexpected bouts of volatility and/or an economic hard landing. We believe climate transition strategies could perform well while pursuing carbon reduction strategies at the same time.

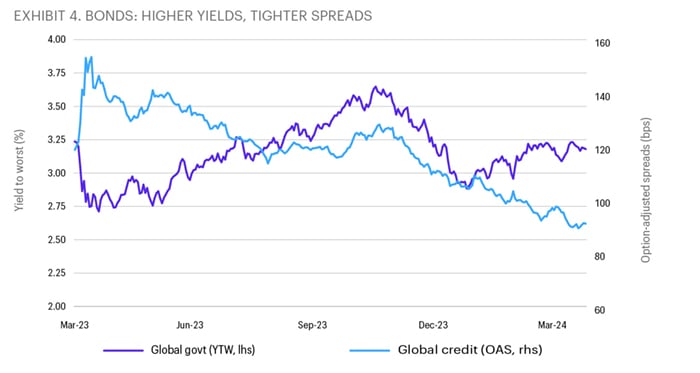

- Be intentional with risk. Yields in many markets remain high relative to inflation while credit risk premiums are quite narrow (Exhibit 4). Globally, government bond yields have risen modestly so far this year but remain below the peak levels experienced in 2023. Although yields have risen, the extra yield a bond investor receives for investing in nongovernment credit debt has narrowed due to favorable economic growth dynamics. In this environment, bond investors could consider adding high nominal and real yields to build durable, inflation-beating cash flows over multiple years. This was doable in 2023 and should be in 2024, too.

Sources: Allspring and Bloomberg Finance LP. Each sector is part of the Bloomberg Global Aggregate Bond Index. Data is as of 29-Mar-24. 100 basis points (bps) equal 1.00%.

- Positioning: Consider moving up in quality and focusing on high-quality cash flows. Structured cash flows in asset-backed securities, MBS, and other structured products can allow investors to diversify cyclical risk inherent in single-issuer corporate credit. Tax-exempt municipal debt in the U.S. also allows bond investors to move up in quality and de-emphasize cyclical exposure.

- Strategies: Bond strategies that track the “core” of the taxable and tax-exempt bond markets offer a high-quality bias and mid-market duration that could provide stable cash flows and protection against an economic hard landing.

Use income to generate desirable outcomes

Financial markets started 2024 amid a “Goldilocks moment” for the U.S. economy while Europe, Asia, and some emerging economies faced challenging economic outlooks. To offset these mounting headwinds, many central banks worldwide pivoted to an easier policy stance. This macro backdrop should benefit fixed income returns as it favors lower interest rates over time and a wider trading range for credit premium.

The recent pullback in bond prices has pushed yields higher, affording an attractive entry point to position bond portfolios for capturing positive real yields plus some capital appreciation. Major risks to this bond-friendly environment include possible central bank policy errors, U.S. elections in November, and potential military escalations in the Middle East and/or Eastern Europe.

1. Trend inflation is the long-term estimate of the inflation rate based on price data through the present date (date the calculation is made).

Diversification does not ensure or guarantee better performance and cannot eliminate the risk of investment losses.